Welcome to the thrilling world of Family Budgeting, where numbers dance and pennies pinch themselves in excitement! Imagine a life where your bank account doesn’t resemble a sad, deflated balloon but instead floats happily, inflated with purpose and planning. Family budgeting isn’t just about saying no to that tempting new gadget; it’s about saying yes to that dream vacation or the kids’ college funds.

Buckle up as we navigate through the essentials of making your family finances both fun and functional!

In this delightful journey, we’ll uncover the secrets of tracking income, expenses, and savings like a pro. We’ll also explore budgeting methods that even your kids might find interesting (yes, really!), from the mystical zero-based budget to the fabulous 50/30/20 rule. So, grab your calculators and a sense of humor as we dive into the captivating art of family budgeting!

Understanding Family Budgeting

Creating a family budget is like drawing a treasure map for your finances. It helps you navigate the sometimes stormy seas of expenses while steering clear of those pesky icebergs of debt. A well-crafted budget not only promotes financial health but also fortifies family harmony, making sure the only arguments over money are about whether to save for a family trip to Disneyland or a new backyard trampoline.A family budget is composed of three essential components: income, expenses, and savings.

Each component plays a crucial role in maintaining financial stability. Income is the treasure chest, filled with gold (or cash!) that comes from salaries, side hustles, or even that mysterious uncle who insists on gifting you cash for no reason. Expenses are the sneaky pirates that plunder your treasure, including bills, groceries, and the occasional impulse buy (because who doesn’t need a 12-foot inflatable unicorn?).

Finally, savings are the wise old sages who whisper, “Save for a rainy day, or a sunny trip!”

Components of a Family Budget

To truly harness the power of budgeting, it’s important to clearly define each component. Here’s a closer look at what should be included:

- Income: This includes all sources of money entering your household, such as salaries, bonuses, freelance work, and any other side gigs.

- Expenses: All outgoing funds should be accounted for. This includes fixed expenses like rent or mortgage, utilities, and insurance, as well as variable expenses like groceries, entertainment, and that sneaky coffee habit.

- Savings: Aim to allocate a portion of your income for savings. This can cover emergency funds, retirement accounts, or that fun family vacation you keep dreaming about.

Understanding how to effectively allocate your income can help prevent those dreaded financial crunches. Two popular budgeting methods that can assist families in managing their finances are the zero-based budget and the 50/30/20 rule.

Budgeting Methods for Families

Exploring different budgeting methods can help find the best fit for your family’s unique needs. Here’s a brief overview of two effective approaches:

- Zero-Based Budget: In this method, every dollar you earn is assigned a specific job, whether that’s for bills, savings, or fun (because yes, fun counts!). The goal is to have your income minus expenses equal zero. It’s a great way to ensure that every cent is being utilized effectively, like a family of squirrels preparing for winter.

- 50/30/20 Rule: This straightforward approach divides your income into three categories: 50% for needs (rent, utilities, groceries), 30% for wants (dining out, entertainment), and 20% for savings and debt repayment. It’s like a financial pizza, ensuring each slice is tasty and satisfying without the crust of regret!

“A budget is telling your money where to go instead of wondering where it went.” – John C. Maxwell

By understanding these components and methods, families can navigate their financial journey with confidence, ensuring that they can enjoy the ride without running out of gas (or money) along the way!

Strategies for Effective Budgeting

Creating a family budget is like preparing a delicious stew; you need the right ingredients, a pinch of planning, and a dash of teamwork. With families often juggling a myriad of expenses, effective budgeting becomes crucial. This section dives into strategies that will not only make budgeting easier but also add a sprinkle of fun to the process.

Tracking Family Expenses Effectively

Keeping track of family expenses can sometimes feel like trying to catch a greased pig at a county fair. However, with the right tools and a bit of organization, it can be as easy as pie. To get started, consider using one of these handy tools that can help you keep your budget on track and your expenses in check:

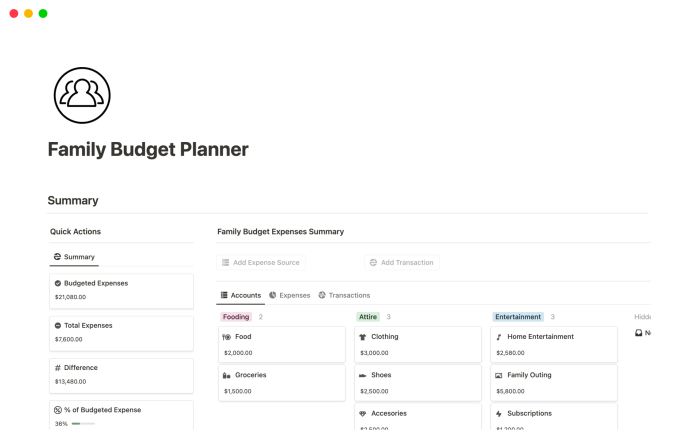

- Budgeting Apps: Apps like Mint or YNAB (You Need a Budget) turn the tedious task of tracking expenses into a fun game of financial whack-a-mole. You’ll be able to categorize your spending and even set goals like “I’ll save for that new family vacation” instead of “I’ll just keep buying lattes.”

- Spreadsheets: If you’re more of a traditionalist, a good old-fashioned Excel spreadsheet can be your best friend. You can create columns for income, fixed expenses, variable expenses, and those occasional surprise costs—like when the family dog decides to eat the furniture.

- Pencil and Paper: For the minimalist at heart, going retro with a notebook allows you to jot down expenses as they come. Plus, it’s a great way to engage your kids in budgeting discussions—especially when they ask why their allowance is being allocated to “cat treats” instead of “toys.”

Reducing Household Expenses

Cutting down on household expenses without sacrificing the quality of life is like trying to find a unicorn in a field of horses—tricky but not impossible! With a little creativity and some smart choices, households can save money while still enjoying the good life.Here’s how to trim the budget fat:

- Grocery Shopping Smart: Meal planning can save you from those pesky impulse buys at the grocery store. By planning meals for the week, you’ll only buy what you need and avoid those “I’ll figure it out later” purchases.

- Utility Optimization: Simple tweaks like switching to energy-efficient light bulbs and unplugging appliances when not in use can shave dollars off your utility bills. Consider it a game: How low can you go on your next bill?

- Family Fun on a Budget: Explore local parks, community events, or movie nights at home instead of expensive outings. Remember, it’s not about where you go but who you’re with. Plus, who doesn’t love a good popcorn fight during a family movie?

Creating a Family Budgeting Plan

Involving the entire family in the budgeting process can turn what is often a dreaded chore into a collaborative adventure. Here’s a step-by-step guide to crafting a budgeting plan that ensures everyone is on board and feels included.

1. Gather Everyone Together

Hold a family meeting, preferably with snacks, to discuss the importance of budgeting. This is where you explain why you can’t buy a Ferrari and need to stick to a budget instead.

2. List Sources of Income

Sit together and jot down all sources of income, including allowance, part-time jobs, and even Grandma’s birthday check. This will give you a clear picture of your financial resources.

3. Identify Expenses

Create a list of necessary expenses such as rent, groceries, utilities, and fun expenses like vacations or family outings. You might find out that the family pizza budget needs to be trimmed a bit.

4. Allocate Funds Together

Discuss how much should go to savings, how much can be spent on fun, and how to divvy up monthly expenses. This could be a great opportunity for kids to learn about saving for that new video game they’ve been eyeing.

5. Regular Check-ins

Schedule monthly family finance check-ups to review the budget. This will allow everyone to see where they stand and help adjust the budget as necessary. Plus, it’s a great time for a mini family celebration if you’ve hit savings goals! By applying these strategies for effective budgeting, your family will not only see improvements in your financial health but also in your teamwork and communication.

It’s budgeting with a side of laughter—because let’s face it, who doesn’t want to laugh while managing their finances?

Adapting the Family Budget

When life throws a financial curveball—like a job loss that feels like a surprise party you never wanted—it’s time to adapt the family budget. Just like adjusting your recipe when you realize you’re out of sugar (who knew?), you can tweak your financial plan to ensure that you stay afloat and continue to reach your goals. Let’s dive into how you can make those budget adjustments without losing your sanity—or your sense of humor.

Adjusting to Changing Financial Situations

Life is about as predictable as a cat at bath time. Unexpected expenses can pop up faster than a magician’s rabbit, from car repairs to medical bills. To tackle these surprises, having a flexible budget is essential. First, identify areas where you can cut back. Think of it as a financial trim—like a bad haircut, but with money! Here are some strategies:

- Emergency Fund: Aim for at least 3-6 months’ worth of expenses tucked away. This is your financial safety net, ready to catch you when life decides to throw a party with no RSVP.

- Review Subscriptions: Those streaming services and magazine subscriptions can pile up like old pizza boxes. Cancel the ones you don’t use—your budget will thank you!

- Flexible Spending: Allocate a portion of your budget for variable expenses. If you notice you’re spending less on groceries one month, shift that cash to a bill or savings.

“Budgeting isn’t about depriving yourself; it’s about making sure you have the things you want.”

Setting and Prioritizing Financial Goals

As a family, setting financial goals is like assembling a team of superheroes to fight against financial chaos. Whether it’s saving for a dream vacation to Hawaii or funding your child’s college education, having clear priorities can help everyone stay motivated. Start by having a family meeting—yes, even the dog can come if it keeps the peace!Consider these steps to keep your financial goals organized:

- Identify Goals: Each family member should share their financial aspirations. It’s a great way to bond and discover just how much your teenager wants that new gaming console.

- Prioritize Together: Discuss and rank goals based on importance and timelines. A vacation might beat a new bike if you’re planning to hit the beach next summer!

- Create a Visual Goal Board: Get creative and make a colorful board showing your goals. This can be a great motivational tool—who doesn’t love a little glitter and glue?

Framework for Regular Budget Reviews

Regular budget reviews are like family game nights—essential for keeping everyone engaged and on the same page. Schedule these reviews monthly to assess progress toward your goals and make adjustments as needed. Here’s how to structure your budget review sessions effectively:

- Gather Statements: Bring all financial documents—bills, bank statements, and that mysterious receipt from two months ago. It’s like a family treasure hunt, but with fewer pirates.

- Track Actual Spending vs. Budget: Compare what you planned to spend against what you actually spent. This is where the magic (or horror) happens.

- Adjust as Needed: If you’re consistently overspending in one area, it may be time to reassess your budget. Maybe eating out three times a week isn’t as necessary as you thought!

By adapting your family budget to life’s unpredictable twists, prioritizing goals, and conducting regular reviews, you can steer your family finances toward a brighter future—all while keeping the laughter rolling!

Closing Notes

As we wrap up this financial fiesta, remember that a well-crafted family budget is your golden ticket to financial freedom, allowing you to chase dreams rather than just bills. By tracking expenses, reducing unnecessary costs, and adapting to life’s curveballs together, your family can not only survive but thrive! So, gather your loved ones, put those budgeting strategies into action, and watch your financial worries float away like confetti in the wind!

Top FAQs

What is the first step in creating a family budget?

The first step is to gather all your financial information, including income sources and expenses, then sketch a preliminary budget to see where you stand.

How often should we review our family budget?

It’s wise to review your budget monthly or whenever there’s a significant change in income or expenses, ensuring you stay on track.

Can we involve kids in the budgeting process?

Absolutely! Involving kids can teach them valuable lessons about money management and make budgeting a family affair.

What if unexpected expenses arise?

Stay calm! Adjust your budget by reallocating funds from less urgent expenses or dipping into your savings if necessary.

Are there apps that can help with family budgeting?

Yes, there are plenty of user-friendly budgeting apps like Mint or YNAB that can simplify tracking your finances and make it almost fun!